- cross-posted to:

- [email protected]

- cross-posted to:

- [email protected]

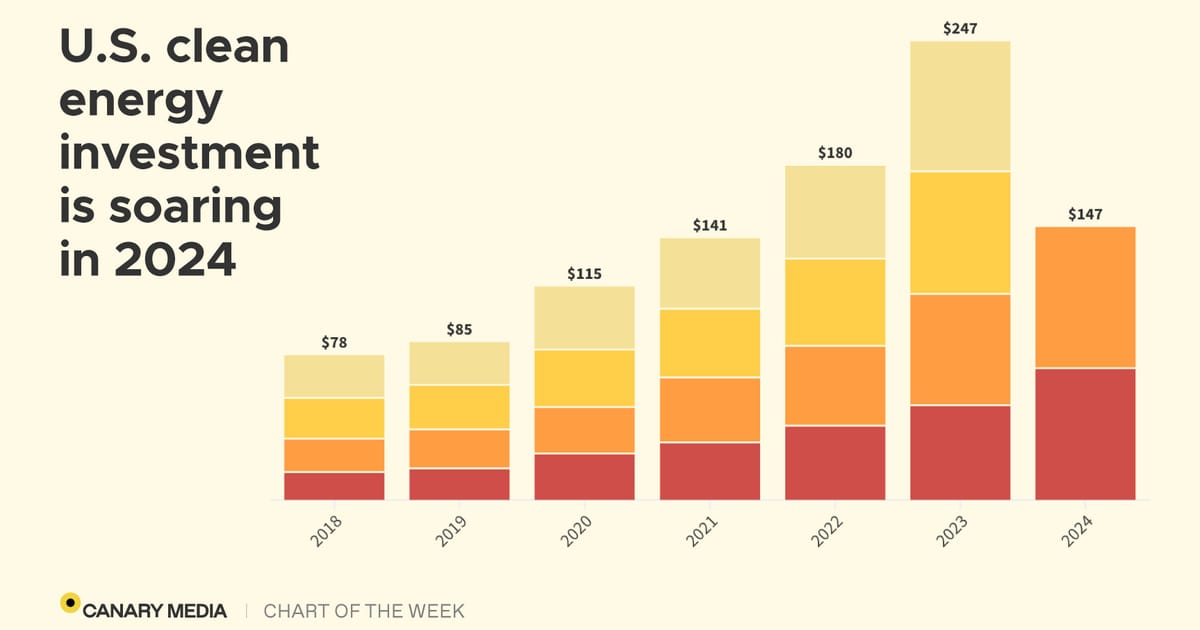

Private and public investment in clean energy rose to a total of $147B in the first half of this year — a record-setting figure.

Exactly two years ago today, President Joe Biden signed the Inflation Reduction Act, establishing a wide array of clean energy programs meant to supercharge spending on climate solutions.

Investment in clean energy projects — from solar manufacturing facilities to home batteries to hydrogen hubs — has taken off ever since, rising to record heights in the first half of this year.

Across the first six months of 2024, U.S. cleantech investment hit $147 billion, per new data from the Clean Investment Monitor, a joint project from Rhodium Group and the MIT Center for Energy and Environmental Policy Research. That’s a more than 30 percent jump from the first half of 2023. The report measures actual investment — not announcements or plans — from both public and private sources.

That was signed 2 years ago. I imagine that this wouldn’t appear in the renewable production metrics for a few years. Energy infrastructure projects don’t go from investment to output quickly. You have planning, hiring, permitting, building, etc. There is also a lag time from when a bill is signed to when an administration can staff offices to accept and review grants, cut checks, etc.

The federal government usually issues a report about annual energy production at the end of the calendar year. The report usually gets posted in Feb or Mar after the information has been collected and synthesized.

We might see a bump in the 2024 report, assuming Trump doesn’t win and we actually get a 2024 report. That said, I wouldn’t expect to see this money impacting the grid for a few more years out.